- What is liquidation? Liquidation is CBP’s final computation of duties on an entry. After liquidation, the duty amount becomes “final” unless timely challenged.

- Typical timing: In the ordinary course of business, CBP liquidates entries at 314 days after entry release, unless extended or suspended (e.g., AD/CVD cases).

- Correcting unliquidated entries (before liquidation):

- Post Summary Correction (PSC) may be filed up to 300 days from the entry date and no later than 15 days before the scheduled liquidation date. Most entry details can be corrected via a PSC. Currently there is no provision for filing a PSC on the anticipated overturn of IEEPA duties.

- Correcting liquidated entries (after liquidation):

- Protest (19 CFR Part 174)—file within 180 days of liquidation to update entry details or to contest a CBP decision on the entry (classification, valuation, duty assessment, etc.).

- Protest (19 CFR Part 174)—file within 180 days of liquidation to update entry details or to contest a CBP decision on the entry (classification, valuation, duty assessment, etc.).

IEEPA context: In regard to the possibility of the IEEPA duties being found unlawful, it is not certain what the refund process will be. The refund process and what is eligible will depend in part on how the final court ruling is issued.

There are opposing opinions on whether or not importers should take action now, BEFORE entries liquidate, to protect refunds. Some legal counsel suggest as a protective measure, importers file suit with the Court of International Trade (CIT). The appeal filed with the CIT seeks to prevent Customs from liquidating IEEPA entries so that the entries stay suspended and therefore will not be precluded from the refund process. This is a protection in the event refunds are limited to only unliquidated entries, which is the potential concern. The CIT recently ruled that for court cases filed, liquidation of an entry will not bar the court from issuing refunds if the IEEPA tariffs are found to be illegal. The court also indicated that IEEPA refunds may not be recoverable merely by filing administrative protests against liquidation.

DOJ Position: The Department of Justice (DOJ), representing U.S. Customs and Border Protection (CBP), has recently stated that liquidation does not bar recovery. The Court of International Trade (CIT) retains authority to order reliquidation and refunds even after liquidation occurs. So if the Supreme Court finds the IEEPA tariffs unlawful, it is possible that the CIT could order reliquidation of entries to plaintiffs’ entries, which would result in the refund of duties. However, the DOJ is not saying this would be automatically done by the Trump Administration

So it remains uncertain that there will be duties refunded or what the refund procedures will be.

In any case, it is imperative that importers track the status of liquidation of their entries and work closely with their broker(s) to ensure potential refunds as we learn more about the process.

M.E. Dey “IEEPA Duty Liquidation Monitoring”

1) Import Invoice Line Report (Cargowise) provided by M.E. Dey and delivered monthly

Purpose: A line-level view to identify entries with potential IEEPA duty refunds , status, and approaching liquidation/protest deadlines. The configuration with all required detail is labeled as “. Report Configuration: IEEPA report”

Core fields (per invoice line):

- Entry number, line number, entry date, scheduled liquidation Friday, current status (unliquidated/extended/suspended/liquidated)

- HTS line + IEEPA indicator (e.g., Chapter 99 provisions if applicable) and duty paid (IEEPA component breakout)

- Value/quantity, country of origin, supplier, port etc.

- Note: This will only include entries filed by M.E. Dey

- A one-time set up fee of $250 will apply to establish this reporting process.

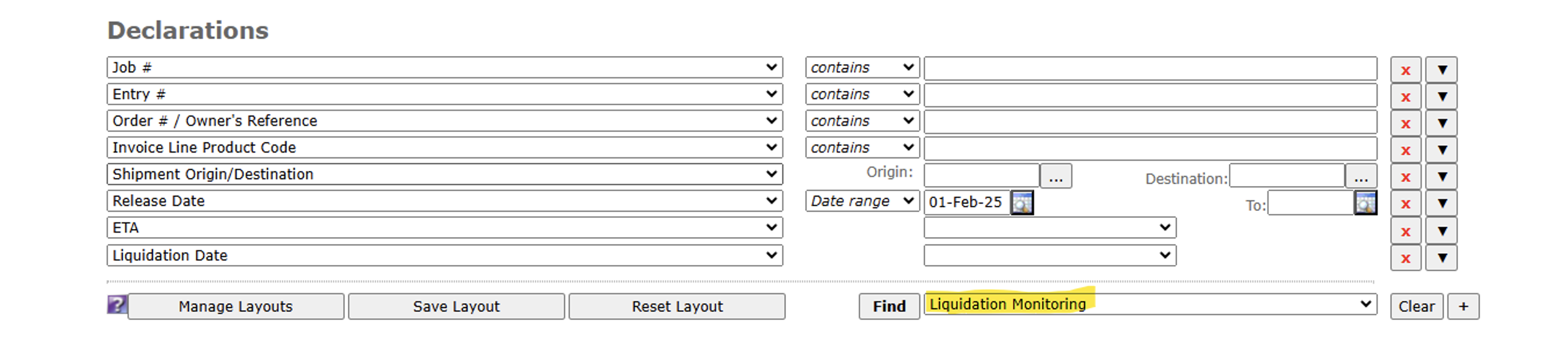

2) WebTracker Filter on M. E. Dey tracking platform:

Purpose: Give importers a one-click dashboard to isolate entries impacted by IEEPA and at risk of losing correction windows. Importers can pull their own information as often as possible by pulling data from M.E. Dey webTracking module.

Key filters “Liquidation Monitoring”:

- Liquidation status: Unliquidated / Scheduled this Friday / Extended / Suspended / Liquidated (with posted date) [cbp.gov], [trade.cbp.dhs.gov]

3) Push Notices (Email Notices)

Purpose: Keep importers proactively informed on a shipment level when entries liquidate. An email will automatically be generated to designated people within an organization once an entry is liquidated with entry-specific details. Importers can use this information to track potential dates/deadlines and refund opportunities.

4) ACE Portal

This is CBP’s official platform for managing and monitoring import activity. Having an ACE portal gives importers direct visibility on all their entry data, duty payments, and compliance status – without relying solely on brokers. If you work with more than 1 broker, you can view all entries in one place. This is something an importer needs to apply for directly with CBP to s

-

- ACE Reports to help monitor Liquidation:

- ES-010: Future Liquidations – Shows entries scheduled for liquidation

- ES-109: Liquidated Entries – Confirms which entries have liquidated and when

- ACE Reports to help monitor Liquidation:

If you’d like to learn more about how to monitor your entries or to activate any of these options, please reply to Sarah@medey.com, and we’ll tailor your filters and alerts to your entry portfolio.